- #Personal budget excel spreadsheet free how to#

- #Personal budget excel spreadsheet free professional#

The beauty in a 50/30/20 budget is that it’s simple. If you’ve never followed a budget before or struggled to follow one in the past, try the 50/30/20 budget. The 50/30/20 budget is great for people who want to be more mindful of their spending but prefer a simple and flexible budget. The idea behind it is that you should allocate 50% of your income toward needs, 30% toward wants, and 20% toward savings and debt repayment. The 50/30/20 budget is a popular budgeting strategy. 50/30/20 personal monthly budget template But if you want something with a little more firepower, has you covered - more on that soon. If you like working with spreadsheets and you only need a simple tool for your personal or household budget, a Google Sheets template is a workable option. Like most others, it has a summary page that shows your “planned” and “actual” income and expenses, as well as a “difference” column that shows you how over or under budget you were in that particular category. This monthly budget worksheet is easy to use and lets you track your monthly expenses and income across a variety of budget categories. There are many different Google Sheets budget templates out there. Here are some examples of how you might use a personal monthly budget. There are various kinds of monthly budgets with different applications. What are some examples of a personal monthly budget? A monthly budget also lets you see how your spending fits into your annual budget.

#Personal budget excel spreadsheet free how to#

And if you have debt you’re trying to pay off - you can use your budget as a roadmap for how to get rid of it. Your monthly budget isn’t just a snapshot of your current financial situation - it can also be a tool for long-term goal planning.įor instance, if you’re trying to save up for a down payment on a house, you can create a budget that allocates a certain percentage of your income toward your goal each month. Aids in long-term financial goal planning Plus, most monthly budget templates come with options to graph or chart your data over time, giving you an easy-to-digest visual representation of your finances.

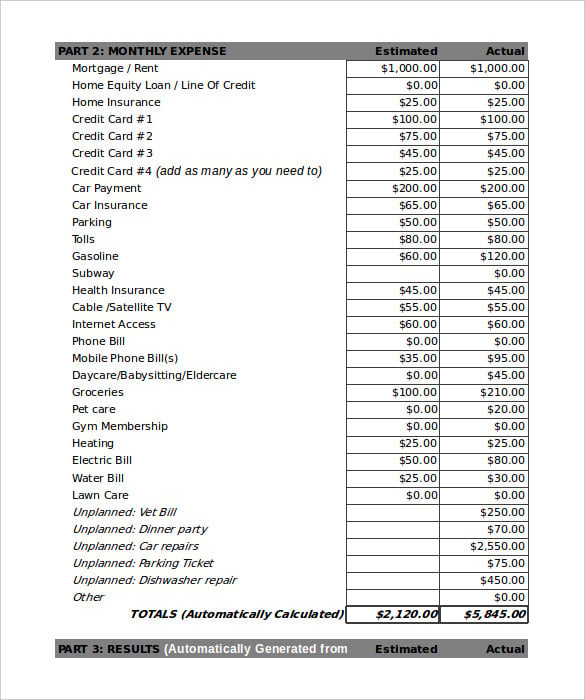

On the flip side, if you’re under-budgeting in another area, you can make adjustments that better reflect your spending habits. Having all your income and expenses in one place makes it easier to see day-to-day or week-to-week.įor example, if you’re overspending in a particular category, you’ll be able to see it right away. A well-crafted budget can help you save money, pay down debt, and achieve other financial goals. Preparing a monthly budget is essential for anyone looking to gain more control of their personal finances. For that reason, you won’t have a true representation of your financial health and you could be missing valuable information that can help you make better-informed decisions. Without a budget template, minor or variable expenses may fall through the cracks and not be accounted for.

#Personal budget excel spreadsheet free professional#

By tracking your expenses and income in a professional template, it’s a lot easier to keep track of minor details. Helps you track minor detailsĪ budget is only as good as the data it contains. Now that you’ve got a handle on what a budget template is, let’s look at a few of the benefits of using one. Expenses: Food, transportation, medical, utility, debt, pet, and variable expensesīudget templates also add these individual amounts together, showing you what you’re spending and earning in each individual category.ĭownload Excel template Why use a personal monthly budget template?.Income: Wages, tips, capital gains, bonuses.Generally, a personal budget template splits your income and expenses into categories like: In other words, a done-for-you template takes the guesswork out of creating a budget. While you can create your own budget planner, using a ready-made template guarantees that you’re not neglecting important financial information.

And most importantly, a monthly budgeting template provides a bird’s eye view of your current financial situation. It lets you compare your budgeted expenses and income versus your actual expenses and income. Get the template What is a personal monthly budget template?Ī personal monthly budget template helps you plan your spending. We’ll also take a look at ’s personal monthly budget template. In this article, we’ll introduce you to a variety of monthly budgeting spreadsheets, worksheets, and planners that can help you in your budgeting journey. Much of the anxiety around budgeting your money can be reduced with a little proactivity, persistence, and the right budgeting template.

0 kommentar(er)

0 kommentar(er)